- June 2, 2020

- Posted by: Ganeshcbani

- Category: Blog

What is EMI?

Equated monthly repayment-short EMI-is the amount payable to the bank or to any financial institution per month before full payment of the loan is made. It contains both the interest on the loan and part of the amount to be repaid. The amount of the principal sum and interest shall be divided by the number of months within which the loan has to be paid back. This volume must be charged on a monthly basis. In the first few months, the interest portion of EMI will be greater and reduced slowly with each payment. The exact percentage added to the principal is determined by the interest rate. Even if your monthly EMI payment doesn’t change, the proportion of principal and interest components will change over time. You would pay more to the principal and less in interest for every successive charge.

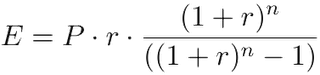

The formula for the EMI estimation is as follows:

Formula EMI

Where?

I’m EMI

P is the principal amount of the loan

R is the monthly rate of interest measured. (i.e. r = annual interest rate/12/100. If the interest rate is 10,5% annually, then r = 10,5/12/100 = 0,00875)

n is loan term / period / length for months in amount

For example, if you borrow 10.5 percent (120 months), then EMI = = 0.00875 * (10 + 0.00875)120 / (((1 + 0.00875)120-1) = 0.0013.493 from the bank. For example. That is, for 120 months, you will have to pay $13,493 to repay the entire cost of the loan. The total amount payable shall be CHF13.493 * 120 = CHF16.19.220 plus CHF6.19.220 as interest in the loan.

EMI is time consuming, complex and error-prone to calculate various combinations of capital loan, interest rates, and the loan term using the EMI formula described above. This is handled by our EMI calculator and the effect is a split second along with visual charts showing the payment plan and a breakdown in the overall payment.

How will EMI Calculator be used?

Our EMI calculator is simple to use, intuitive to understand and quick to perform with colorful charts and instant results. This calculator can be used to measure EMI for a home loan, car loan , personal loan, educational loan or some other completely amortizing loan.

Enter in the EMI calculator the following information:

Significant amount of loan you want to use (rupees)

Terms of loan (months or years)

Interest rate (percentage)

Calculation of EMI Personal Loan using Excel Sheet

The EMI calculation function in Excel is PMT.

Three variables are needed to calculate the EMI. You are:

The monthly rate of interest (rate)

The number of the time (nper)

The actual loan value (pv).

The outcome is always negative for the cash outflow.

The formula to enter in excellence is: = PMT (rate, nper, pv)

For example: Let us assume that your annual personal loan rate is 12% per year, then the monthly rate is: 12% /12 = 1% or 0.01.

Let us also say that the term for loans is 4 years. Therefore, you have to pay for the duration or amount of EMIs over the course of the loan period (4 x 12). If your value of the loan is Rs.4,45 lakh, we obtain an EMI as:

= PMT (0.12/12, 4 * 12, 4.45,000)

Factors concerning the EMI Personal Loan

Loan Amount: The higher the value of the loan, the more payable the EMI. The lender will calculate the maximum sum for the loan based on your repayment potential, relationship with the bank and other factors.

Interest rate: The interest rate is also directly proportional to the EMI in this situation. The higher the interest rate, the higher is the EMI. The bank will calculate the interest rate for your loan based on a variety of factors like your salary, your credit history, your repayment potential, etc.

Loan tenure: The loan tenure you select is inverse to the EMI. The more time it takes, the lower the EMI. Credit term options usually range from 12 months to 60 months.

How can you afford a personal loan from EMI?

The preference of different EMI choices depends, if any, on your income and current obligations. Those two decide the opportunity for reimbursement you may have. Lenders will give you the loan sum in which you can take up to 60% of your net income from an EMI. However, it would be easier if you can do it with a smaller number. Personal loans are unsecured loans which may have higher interest rates. Reduced loans would mean a much lower EMI, which will give you more space to fulfill your other obligations. A sudden increase in monthly expenses is not to be excluded, and if so, you will be saved by a reduced EMI.

Why does an EMI calculator for personal loans allow you to save on advance payments?

Prepayment is a word which implies complete or partial loan payment. You may also move the facility to another lender with a balance transfer at a lower rate. The savings can be big if you pay in advance. This can be supported by a personal EMI loan calculator. When the calculator flashes your personal loan interest figures, you will schedule your payment in advance. Prepayment will have strong savings if you do halfway or even before. Before the first 12 EMIs, most lenders do not permit prepayment. But you can do and save after that. Let’s use the EMI calculator to prepayment from your own sources and to move your balance.

For eg, for five years you have taken an INR 6 Lakh personal loan at an interest rate of 16 percent per year. The loan has been valid for 2 years and the balance remains at INR 4.15,018. The EMI is INR 14,591 for this reason. At this rate, you will pay interest of INR 2,75,450. Now, we will use the EMI personal loan calculator for the full advance payment, part advance payment and balance transfer based on this example.

Total pre payment

The EMI calculator indicates that the interest paid to date is INR 1,65,199. The savings would be INR 1,10,251 if you subtract this from INR 2,75,450. Since the advance payment is made by approximately 2%-4%, you may have to pay about INR 8 300-16 600 + 18% of the goods and services tax(GST). If you consider the GST, it would cost around INR 9,794-19,588 in advance. With the deduction of INR 1,10,251, you can save INR 90,663-1,00,457 as result.

When you make a part payment?

You may accept a partial payment if you do not have the savings you have to pay off the outstanding balance of INR 4,15,018 after 2 years. When you pay INR 2 lakh, the amount remaining will be reduced to INR 2 15 018. The EMI would drop sharply to INR 7,559, although interest obligations for the other three years are projected to INR 57,120. If we consider the interest accrued so far on the outstanding interest of INR 1,65,199, the cumulative sum shall be INR 2,22,319, lower than INR 53,131 if you continue to pay the loan as scheduled at the time of the disbursement.

When advance payments apply, you can subtract the same from INR 53,131 in order to save money. If you charge the prepayment at 2%-4% of the share amount, the fees will be around INR 4,720-9,440, including 18% GST. Deduction of INR 53,131 would result in INR 43,691-48,411 in total. This is the savings you will probably have on a partial payment.

EMI calculator FAQs

Q)How can I use an EMI calculator to make the right choice?

A) The EMI calculator is a very useful device because it not only calculates the EMI credit but also lists the best loan deals in accordance with your qualifications and loan criteria. With different loans, you can compare EMIs by using the EMI calculator. You may compare the list of loans to the specified criteria and make an educated choice.

Q)May I use the same house , car and personal loans EMI calculator?

A) The home loan EMI calculator, the EMI calculator for car loans and the personal loan calculator operate according to the same three criteria. Included in these criteria are loan, term and interest rate. The key difference between the calculators is the maximum amount allowed as input, which allows you to pick the EMI device based on the loan form.

Q)Where EMI calculators more reliable than excel sheets?

A) Precise results from Excel sheets as well as the online EMI calculator can be obtained. The only major difference is that online calculators save you from long, tiring calculations and tabulate your EMI in seconds. Whereas you can put more time and effort into using an excel sheet calculator. That’s why online calculators have become the favorite choice.

Q)What is the amortization schedule for loans?

A) Amortization is a systematic arrangement table for the loan payment process in the context of a loan. The monthly payments taken to repay the loan shall be paid off both the principal and the interest accrued. The loan amortization table gives you a clear idea of the amounts paid over the loan tenure for those two components. Therefore, it is very important to consider the amortization plan in order to fully understand how your loan is paid.

Q)Is the EMI measured by the EMI calculator equivalent to the real EMI bank?

A) Your inputs are based on the EMI calculator method. With respect to the Bank EMI, the loan number, loan term, interest rate and processing fees for the loan may change marginally. If the bank does not accept the exact tenure loan amount, and the interest rate that you use as an input, the EMI you have to pay may be somewhat different to the EMI measured using the EMI calculator tool.